Draghi report

p.20:

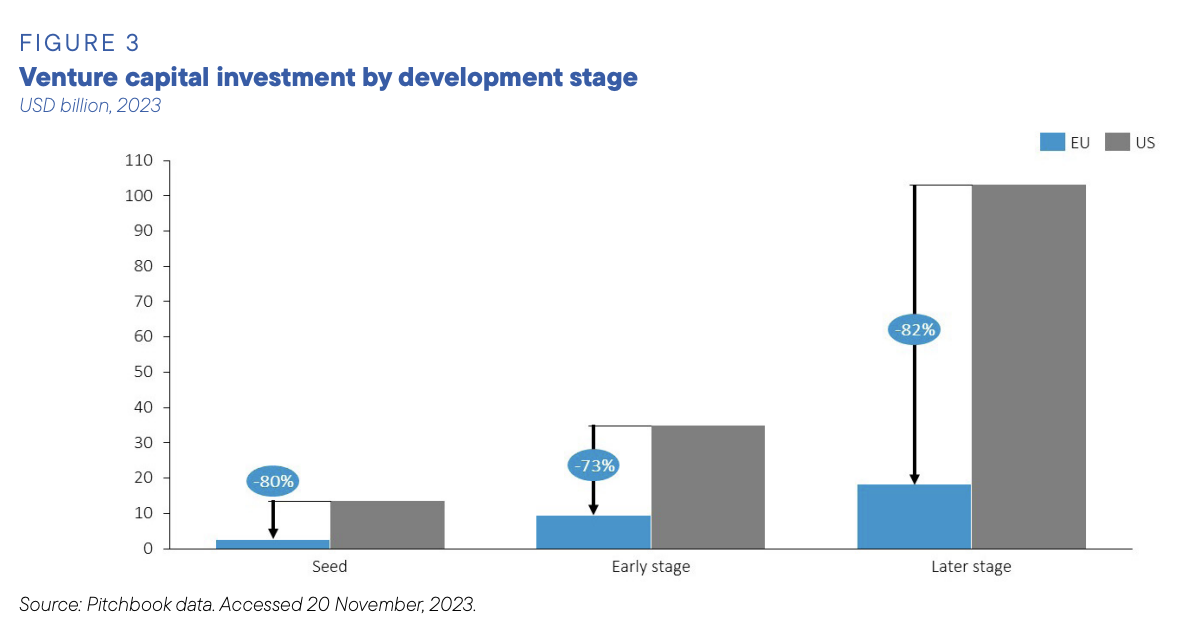

First, it is important that EU companies maintain a foothold in areas where technological sovereignty is required, such as security and encryption (“sovereign cloud” solutions). Second, a weak tech sector will hinder innovation performance in a wide range of adjacent fields, such as pharma, energy, materials and defence. Third, AI – and particularly generative AI – is an evolving technology in which EU companies still have an opportunity to carve out a leading position in selected segments. Europe holds a strong position in autonomous robotics, hosting around 22% of worldwide activity, and in AI services, hosting around 17% of activity02. But innovative digital companies are generally failing to scale up in Europe and attract finance, reflected in a huge gap in later-stage financing between the EU and the US [see Figure 3]. In fact, there is no EU company with a market capitalisation over EUR 100 billion that has been set up from scratch in the last fifty years, while in the US all six companies with a valuation above EUR 1 trillion have been created over this period03.

Many EU companies with high growth-potential prefer to seek financing from US VCs and to scale up in the US market where they can more easily generate wide market reach and achieve profitability faster. Between 2008 and 2021, 147 “unicorns” were founded in Europe – startups that went on the be valued over USD 1 billion. 40 of these have relocated their headquarters abroad, with the vast majority moving to the USx

The lack of growth potential in Europe is particularly relevant for tech-based innovative ventures, and even more so for deep tech ones. For example, 61% of total global funding for AI start-ups goes to US companies, 17% to those in China and just 6% to those in the EU

There are many barriers that lead to companies in Europe to “stay small” and neglect the opportunities of the Single Market. These include the high cost of adhering to heterogenous national regulations, the high cost of tax compliance, and the high cost of complying with regulations that apply once companies reach a particular size. As a result, the EU has proportionally fewer small and medium-sized companies than the US and proportionally more micro companies

On startup financing:

The VC firms investing the largest deal sizes in EU unicorns are located in the US and Asia. Three of the top 10 venture capital firms investing in EU unicorns are located in Silicon Valley, four in New York and two in London. The most active investor in EU unicorns is Palo Alto-based Accel, which has backed 17 unicorns across the EU and is one of the most active venture capital investors in the high-growth ecosystem worldwide.

40 out of our sample of 147 EU unicorns have relocated their headquarters abroad - 32 to the US, 7 to the UK and 1 to Israel.

Lettre ouverte de Meta:

The EU’s ability to compete with the rest of the world on AI and reap the benefits of open source models rests on its single market and shared regulatory rulebook. If companies and institutions are going to invest tens of billions of euros to build Generative AI for European citizens, they require clear rules, consistently applied, enabling the use of European data. But in recent times, regulatory decision making has become fragmented and unpredictable, while interventions by the European Data Protection Authorities have created huge uncertainty about what kinds of data can be used to train AI models.

Problème principal: pas clair, et fragmenté entre Etats.

Répété plus bas:

Europe faces a choice that will impact the region for decades.

It can choose to reassert the principle of harmonisation enshrined in regulatory frameworks like the GDPR, and offer a modern interpretation of GDPR provisions that still respects its underlying values, so that AI innovation happens here at the same scale and speed as elsewhere.